Tax Forms

Employee W-2 Tax and Wage Statements for 2025 have been finalized.

- If you have opted into electronic W-2s, you can now see yours in .

- If you have not opted into electronic W-2s, your paper forms will be mailed by the January 31 deadline.

To opt into electronic delivery and to view your W-2:

- Go to your

- Click Taxes

- Click on either Electronic Regulatory Consent or W-2 Wage and Tax Statement

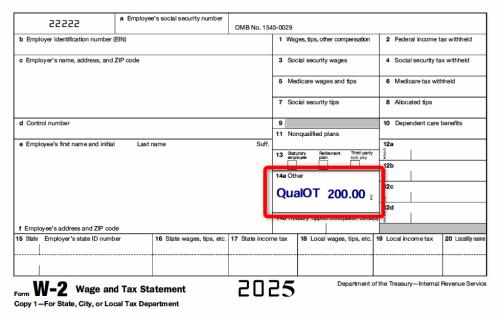

Qualified Overtime

A deduction for qualified overtime compensation is available to certain taxpayers, for tax years 2025 through 2028. Qualified overtime compensation is the “half” part of the “time and a half” overtime and comp time wages that are paid to hourly workers who work over 40 hours per week, in accordance with the Fair Labor Standards Act. If you had qualified overtime compensation during 2025, you will find it in box 14 of your W-2, listed as QualOT.

Questions about W-2s and other payroll issues may be directed to payroll@kent.edu. Please consult your tax or legal advisor for questions about filing your tax returns.